Home warranty and home insurance are two separate terms that are commonly used to protect your house from unexpected damages and disasters. A home warranty is a service contract to cover repairs and replacements while home insurance protects your home from natural disasters. Still, there are many things that you should know about these terms. So let’s delve into the topic of Home Warranty Vs Home Insurance. We’ll also discuss what is a home warranty, what does home warranty covers, and what is a home insurance and what does home insurance covers.

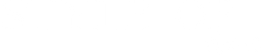

Home Warranty Vs Home Insurance

Home warranty and home insurance have huge differences. Home insurance helps with big problems like tornadoes, hurricanes, or fires. But it doesn’t cover things that just get old and break, like a worn-out water heater, microwave oven, or refrigerator. That’s where a home warranty comes in.

A home warranty helps pay for repairs or replacements when things break from normal use. It’s like having a safety net for your home’s appliances and systems. It’s not required, but it can give you peace of mind. It’s very useful for homeowners as well as sellers who might even buy one to make their home more attractive to buyers.

What is a Home Warranty?

Home warranties are great for people who don’t have money set aside for unexpected repairs or don’t have time to find a reliable repair person. If we talk about Home warranty and home insurance, a home warranty is like a protection plan for your home’s systems and appliances. It helps pay for repairs or replacements when they break.

If you have a home warranty and any appliance of yours is malfunctioning, use your warranty to fix the issue. Just report the issues right away. A technician will come to your home to fix the problem if it’s covered by your plan.

What Does a Home Warranty Cover?

While considering home warranty vs home insurance, home warranty coverage differs between providers, but most cover appliances and built-in systems like AC, plumbing, and heating. Basic plans cover just appliances or systems, while comprehensive plans cover both. You should read your contract carefully to know what’s covered and what’s not.

Although commonly covered items include appliances like washers, dryers, and kitchen appliances, and built-in systems like heating, AC, and plumbing. You can also customize your plan by adding coverage for things like roof leaks spas, and pools.

What Doesn’t a Home Warranty Cover?

Home warranties cover damage from everyday use, but if you haven’t maintained your appliances and systems properly, providers may deny coverage. They also won’t cover damage from pre-existing conditions, accidents, or improper installation.

However, some companies may cover unknown pre-existing conditions that couldn’t be detected by a simple test or inspection.

What is a Home Insurance?

While talking about home warranty vs home insurance, homeowners insurance is not required by law, but lenders usually need it. It covers your home and belongings if something big happens, like a fire or storm. It also covers accidents that happen at your home. This is different from a home warranty, which helps with every day repairs.

What Does a Home Insurance Cover?

Homeowners insurance helps pay for repairs and replacements if your home is damaged by things like fire, theft, falling trees, or bad weather. If your home is too damaged to live in, insurance can pay for temporary housing costs like rent or hotel bills.

Some of the insurance companies for homes also cover injuries that happen at your home. Some policies even cover medical bills if someone gets hurt at your home.

What Doesn’t a Home Insurance Cover?

While comparing home warranty vs home insurance, you should choose wisely if you budge for anyone. If you prefer home insurance, please read company policies carefully before signing up. Homeowners insurance doesn’t cover everything. Floods and earthquakes are not included and need separate insurance policies.

Insurance policies have limits, which means the insurance company will only pay up to a certain amount. If the damage costs more than that, the homeowner must pay the rest.

Conclusion

In short, owning a home means paying for repairs including big problems like storms, and small issues like a broken refrigerator. Insurance helps with big problems, but not small ones. A home warranty helps with small repairs, so you don’t have to worry about unexpected costs. If you have a budget, you should consider both home insurance and home warranty. Keep visiting styleofhome.com for more useful information.

Frequently Asked Questions (FAQs)

What is The Difference Between Home Warranty and Home Insurance?

Home warranty covers repairs and replacements for everyday wear and tear on appliances and systems, while home insurance covers damage from big events like storms and theft.

Do I Need Both Home Warranty and Home Insurance?

Yes, both provide different types of protection and having both can give you peace of mind and financial protection.

What Does a Home Warranty Cover?

Home warranty covers repairs and replacements for appliances, HVAC systems, plumbing, electrical systems, and other home systems and appliances.

What Does Home Insurance Cover?

Home insurance covers damage to your home and property from events like storms, theft, fire, and liability for accidents on your property.

How Long Does a Home Warranty Last?

Typically, a home warranty lasts for one year, but some companies offer multi-year policies.

Read More Helpful Topics: